Lithium Reaches All-time High Price

Oct 18,2022

Oct 18,2022

Basen

Basen

Lithium Reaches All-time High Price

The price of batteries for electric vehicles looks set to rise in 2022 following a decade of sharp decline as supplies of lithium and other raw materials fail to keep up with ballooning demand.

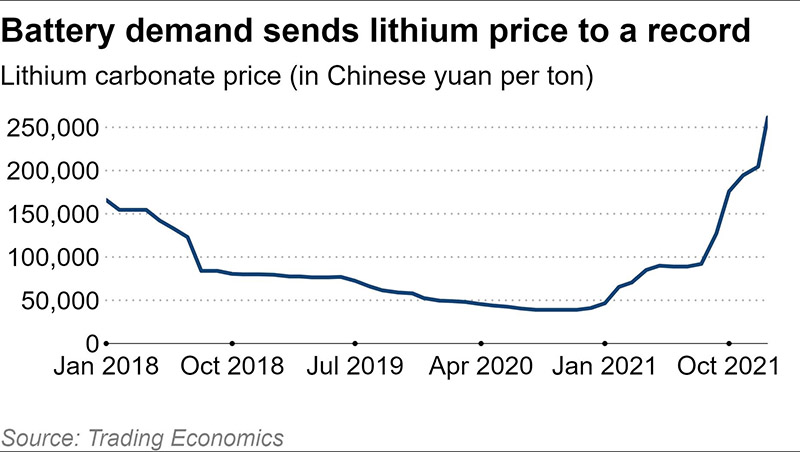

While mining companies scramble to increase production from existing facilities and develop new sources of supply, benchmark prices of lithium carbonate ended 2021 at records. In China, the biggest battery-producing country, the price was 261,500 yuan (just over $41,060) a ton, more than five times higher than last January.

Other commodities used in cathodes, the most expensive part of a battery, have also been rising: The price of cobalt has doubled since last January to $70,208 a ton, while nickel jumped 15% to $20,045.

The increases are undermining the technological and efficiency gains of recent years, when automakers and battery makers have worked hard together to develop long-life, high-performance batteries while trying to reduce costs. They also threaten to throw a wrench in the car industry's ambitious plans for electrification just as even formerly reluctant companies like Toyota embrace targets for electric vehicle production.

According to Bloomberg NEF, global electric car sales are estimated to have reached 5.6 million vehicles in 2021 from 3.1 million in 2020, thanks to brisk sales in China. Further demand growth in 2022 will mean a lithium deficit this year as use of the material outstrips production and depletes stockpiles, according to a December report from S&P Global.

The report said that according to S&P Global Market Intelligence, supply is forecast to jump to 636,000 metric tons of lithium carbonate equivalent in 2022, up from an estimated 497,000 in 2021 -- but demand will jump even higher to 641,000 tons, from an estimated 504,000.

Gavin Montgomery, research director for battery raw materials at Wood Mackenzie, said lithium prices are unlikely to crash, as they did in previous cycles: "We're entering a sort of new era in terms of lithium pricing over the next few years because the growth will be so strong."

In the short term, supplies will be limited. Producers in Australia closed down mines in 2020 after a period of low prices, and as COVID-19 lingers, it has proved difficult to rehire staffers and bring production back to pre-pandemic levels.

Meanwhile, Chinese lithium-processing companies that make lithium carbonate were affected by restrictions on power use introduced suddenly in the autumn. Though some of those restrictions have eased, companies appear to be struggling to catch up.

For cobalt, pandemic-induced transportation disruptions and border closures in Africa have been behind the soaring prices. The emergence of the omicron variant has added new disruptions in the main trade route from cobalt-producing Congo through the South African port of Durban to China.

One lithium trader in Japan told Nikkei Asia they expect prices to remain at current high levels, saying, "Based on automakers' electric car targets, we doubt there is sufficient supply of raw material." New technologies such as all-solid-state batteries would need even greater amounts of lithium, the trader added.

According to Bloomberg NEF, prices of lithium-ion battery packs were above $1,200 per kilowatt-hour in 2010 but plummeted to $132 by 2021. However, the company estimates that average prices could rise to $135 per kilowatt-hour in 2022. Cathode materials usually make up around 30% of the total cost of battery packs.

The pressure is on to secure new supplies of raw materials as the global car industry pivots away from the combustion engine to electric cars. Volkswagen and BMW aim to have half their vehicle sales be electric by 2030. Ford Motor expects 40% of its sales globally to be electrified by 2030. In a surprising move, Toyota in December said it would sell 3.5 million electric vehicles in 2030, shedding an image that the company is cautious about the switch to electric vehicles.

Independent battery makers are racing to increase their sources of supply, including the likes of China's CATL, the world's biggest battery producer. China accounts for over 65% of global battery production and over half of lithium chemical production, a dominance that worries many in the car industry at a time of geopolitical tensions.

"No country can compare to China in terms of cost competitiveness," said the Japanese lithium trader. "There are certainly geopolitical or China risks in the supply chain."

Tesla in 2020 secured its own rights to extract lithium from clay deposits in Nevada, an early example of an automaker working to cut out the middleman. In the same year, BMW signed a five-year cobalt supply agreement with Moroccan producer Managem in a deal worth $113 million.

Last month, Volkswagen signed a deal to source the Vulcan Group's "zero carbon" lithium to supply its battery cell factories. The German carmaker announced in the same month that it would establish a joint venture with Belgian materials company Umicore to build up production capacity for precursor and cathode materials in Europe.

Toyota said it has secured enough supplies of battery raw materials, including lithium, to meet its needs until 2030 through cooperation with the trading house Toyota Tsusho, in which Toyota has a stake of around 20%.

Sanshiro Fukao, a senior fellow at the Itochu Research Institute, said carmakers see raw materials as "bargaining chips" in negotiations with battery makers, and failing to secure commodities would mean they would have no choice but to buy expensive batteries from them. In the global race to produce lower-cost electric vehicles, that could be fatal.

Sourcing battery raw materials could soon prove as problematic for many carmakers as sourcing semiconductors has in the past year, Fukao said, and it is possible that carmakers may not be able to produce electric vehicles in the numbers planned due to shortages of materials.

"Whether they can secure raw materials today determines if they can prevail 10 years from now," he said.

Any questions about the lithium batteries? Basen experts are ready to help. Get in touch and we’ll find the solution you need.

HOME

HOME

How To Connect Batteries In Series And Parallel?

How To Connect Batteries In Series And Parallel?

You May Also Like

You May Also Like

Tel

Tel

Email

Email

Address

Address